Your cart is currently empty!

Month: February 2022

BlackBull Markets Reviews Read Customer Service Reviews of blackbull com

Today, BlackBull offers over 26,000 tradeable symbols; 2,500 are available on MetaTrader 5 (716 in Prime account) and TradingView, and 311 symbols on MetaTrader 4. The table below summarizes the different investment products available to BlackBull Markets clients. Unfortunately, BlackBull Markets doesn’t offer a no-deposit bonus for new clients.

That said, BlackBull still has room to further improve against the competition. We’d love to see the broker acquire more regulatory licenses in Tier-1 jurisdictions, which would only improve its Trust Score. BlackBull Markets recently expanded its market research coverage with the acquisition of research firm ATM Strategy.

Considerable progress has been made in the broker’s research offering, though BlackBull Markets still trails behind the best forex and CFD brokers in this category. This means that you can trade using micro lots, equivalent to 1,000 units of the base currency, which is the same as trading with a 0.01 lot size. BlackBull Markets offers an Institutional account, which is meant for high-volume traders. BlackBull Markets is a Forex broker that gives you a wide range of instruments to trade besides Forex. While writing this review I was surprised by the number of instruments. With over 26k tradable assets, you won’t have a hard time finding an instrument that matches your trading style.

This ensures that your trades go directly to the market, and there’s no intervention or dealing desk manipulation. This broker is an ECN broker, meaning that it uses electronic systems to match buy and sell orders in financial markets. This results in tight spreads, fast executions, and more transparency. In this article, you’ll get a review of this broker, including analysis and instructions to open an account with BlackBull Markets. People who write reviews have ownership to edit or delete them at any time, and they’ll be displayed as long as an account is active. I was waiting for my application to get approved and decided to ask customer service for a status update.

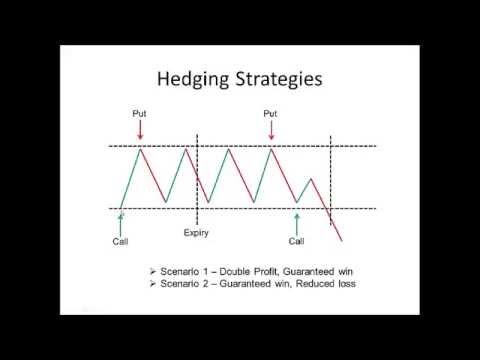

See how BlackBull Markets stacks up against other brokers. Use our country selector tool to view available brokers in your country. You are allowed to do copy trading on your BlackBull Markets account. There are no restrictions against hedging with your BlackBull Markets account. BlackBull Markets offers Micro Accounts to its customers. If your equity (Balance + Open Profit or Loss) falls below the required margin you will receive a margin call.

The interface is easy to use, deposits and withdrawals fast and easy with many different options. The best part is their super fast and excellent customer service on WhatsApp, especially Mariana of their team. There is a very high degree of risk involved in trading securities. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. It’s also important to note that BlackBull Markets xcritically has a relatively small number of regulatory licenses.

Forex Risk Disclaimer

She was very kind and approved my documents needed for verification just after few hours I sent them. Read our full explanation and accounting of our research and testing process to learn more about how we test. Founded in 2014, BlackBull Markets is a forex and CFD broker headquartered in New Zealand. The broker has been fully authorized by the Financial Markets Authority (FMA) in New Zealand since 2020, and registered on the Financial Services Provider Register (FSPR) since the end of 2014. The BlackBull Markets brand also holds a license in the offshore island nation of Seychelles with the Financial Services Authority (FSA).

If your thing is EA trading, and your trading volume exceeds the minimum threshold, then apply to your free VPS. What this means is that your free margin must always be above 50%. If it falls under this value, the platform will start to automatically close your positions to keep the free margin above the threshold.

In May 2023, BlackBull Markets received an investment from Milford Asset Management, a prominent private equity firm in New Zealand, which included the appointment of an independent Chairman. BlackBull Markets accepts residents from all over the world except some specific countries. BlackBull Markets doesn’t accept clients from the United States, Canada, and OFAC-sanctioned countries. The minimum amount to be able to request a withdrawal from BlackBull Markets is $1. This may change based on the withdrawal method that you chose. Net accounts are especially useful when you want to be able to add and reduce your position size.

- I’ve been with Blackbull for a while, after having a bad experience with other brokers.

- When you open an account with BlackBull Markets, you can be sure that you will be trading with a regulated broker.

- If you don’t like hedging accounts, there’s also an alternative.

- BlackBull Markets gives you access to the most popular trading platforms used by Forex brokers.

- BlackBull Markets is a maturing broker that has been in operation for nearly a decade and has made great strides over the last two years toward improving its value proposition to traders and investors.

Steven Hatzakis is the Global Director of Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. Select one or more of these brokers to compare against BlackBull Markets.

Popular Forex Guides

BlackBull Markets is a xcritical official site forex broker located in Auckland, New Zealand, and was founded in 2014. It goes against our xcriticals to offer incentives for reviews. We also ensure all reviews are published without moderation.

BlackBull Markets Reviews

This account charges commissions based on the lot size that you trade with a value of $4.00 per lot. When trading BlackBull Markets forex currency pairs, your lot sizes start at 0.01 and can go up to 100. After almost two years of trading, they decided to remove all profits (10k). They never bothered to show any evidence, or give a detailed explanation. All they said was that my trading account “appears to exploit specific market conditions”. Before that, I never heard any remark from them.They even dared to say that my trading is against the ethical standard of their trading framework.

BlackBull Markets Account Types

You can opt to copy-trade as many signal providers as you want. The only condition is that you have enough funds and your copy-trading parameters allow it. This is great because you can stop trading for the time that you want, and you can be sure that no inactivity fee will be charged to you.

The main differences are the lower spreads and commissions. A bigger deposit scammed by xcritical is also required which is at least $20,000. You get the same high leverage as in the other account types. You can use TradingView to trade, but the best of all is that you are eligible to have a Premium TradingView plan for free. The only condition is that you trade at least 10 lots per month. When you open an account with BlackBull Markets, you can be sure that you will be trading with a regulated broker.

Education

ForexBrokers.com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. BlackBull Markets offers multiple platforms, including the full MetaTrader suite (MetaTrader 4 and MetaTrader 5), cTrader, TradingView, and multiple social copy trading apps. The BlackBull CopyTrader is completely free either to join or to use. There’s also no minimum deposit needed to start copy trading their signal providers.

ShockWave Medical Stock Quote SWAV Stock Price, News, Charts, Message Board, Trades

Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return.

An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. The Zacks Industry Rank assigns a rating to each of the 265 X (Expanded) Industries based on their average Zacks Rank. Plus, SWAV info will be updated daily in your Zacks.com Portfolio Tracker – also free.

This of course has caused the company to see substantial growth in its earnings. With that said, the latest industry analyst forecasts reveal that the company’s earnings growth is expected to slow down. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company. Shockwave Medical issued an update on its FY 2023 earnings guidance on Monday, August, 7th. The company provided earnings per share (EPS) guidance of for the period. The company issued revenue guidance of $725.00 million-$730.00 million, compared to the consensus revenue estimate of $716.10 million.

Shockwave Medical Inc (NASDAQ:SWAV)

The company is scheduled to release its next quarterly earnings announcement on Monday, November 6th 2023. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. We’d like to share more about how we work and what drives our day-to-day business. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. Compare

SWAV’s historical performance

against its industry peers and the overall market.The Bad News Keeping This Top Stock Trapped Under Its 50-Day Line – Investor’s Business Daily

The Bad News Keeping This Top Stock Trapped Under Its 50-Day Line.

Posted: Fri, 14 Jul 2023 07:00:00 GMT [source]

We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

ShockWave Medical Insider Trades Send a Signal

The ‘return’ is the amount earned after tax over the last twelve months. So, this means that for every $1 of its shareholder’s investments, the company generates a profit of $0.40. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

ShockWave Medical Inc is a medical device company focused on developing and commercializing products intended to transform the way calcified cardiovascular disease is treated. Its intravascular lithotripsy technology is used in the treatment of calcified plaque. Geographically, the company generates its revenue from the United States, Europe and other countries. SANTA CLARA, Calif., Sept. 11, (GLOBE NEWSWIRE) — Shockwave Medical, Inc. SWAV, a pioneer in the development and commercialization of transformational technologies for the treatment of cardiovascular disease, announced today that Chief Financial Officer Dan Puckett plans to retire in the first quarter of 2024. Dan has served as the CFO at Shockwave since he joined the company in 2016.

Shockwave Medical started at buy with $39 stock price target at Canaccord Genuity

More value-oriented stocks tend to represent financial services, utilities, and energy stocks. These are established companies that reliably pay dividends. Overall, we are quite pleased with Shockwave Medical’s performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company’s expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Is Shockwave Medical fairly valued compared to other companies? The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals.

How has SWAV performed historically compared to the market?

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures asset quality meaning the profitability of a company in relation to shareholder’s equity. Boston Scientific is reportedly interested in acquiring Shockwave.

The cardiovascular disease technologist delivered mixed Q2 results. All statements, other than statements of historical facts, are statements that could be deemed forward-looking. You are cautioned not to place undue reliance on these forward-looking statements. Forward-looking statements are only predictions based on our current plans, expectations, estimates, and assumptions, valid only as of the date they are made, and subject to risks and uncertainties, some of which we are not currently aware. Next, on comparing with the industry net income growth, we found that Shockwave Medical’s growth is quite high when compared to the industry average growth of 9.3% in the same period, which is great to see.

Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations.

There are currently 1 hold rating and 6 buy ratings for the stock. The consensus among Wall Street equities research analysts is that investors should “moderate buy” SWAV shares. High-growth https://1investing.in/ stocks tend to represent the technology, healthcare, and communications sectors. They rarely distribute dividends to shareholders, opting for reinvestment in their businesses.

Zacks Earnings ESP (Expected Surprise Prediction) looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score. One share of SWAV stock can currently be purchased for approximately $221.12.

It’s Jobs Friday, Beyond Meat Leads the IPO Pack, and More to Know About Stocks

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.32% per year. These returns cover a period from January 1, 1988 through July 31, 2023.

It also provides product for the treatment of coronary artery disease, such as C2 IVL catheter and C2+IVL catheter that are two-emitter catheters for use in IVL system. It serves interventional cardiologists, vascular surgeons, and interventional radiologists through sales representatives and managers, and distributors. The company was incorporated in 2009 and is headquartered in Santa Clara, California.

The Board of Directors has initiated a process to identify a successor. Mr. Puckett plans to continue as the Chief Financial Officer until his successor is appointed. 7 Wall Street equities research analysts have issued “buy,” “hold,” and “sell” ratings for Shockwave Medical in the last year.

To begin with, Shockwave Medical has a pretty high ROE which is interesting. Additionally, the company’s ROE is higher compared to the industry average of 9.2% which is quite remarkable. As a result, Shockwave Medical’s exceptional 75% net income growth seen over the past five years, doesn’t come as a surprise. Remarks from a healthcare company executive got investors excited about medical device makers. The technique has proven to be very useful for finding positive surprises. In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time, while they also saw 28.3% annual returns on average, according to our 10 year backtest.

Click the “See More” link to see the full Performance Report page with expanded historical information. Provides a general description of the business conducted by this company. The Barchart Technical Opinion rating is a 72% Sell with a Strengthening short term outlook on maintaining the current direction. What you need to know… The S&P 500 Index ($SPX ) (SPY ) Monday closed up +0.24%, the Dow Jones Industrials Index ($DOWI ) (DIA ) closed up +0.62%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) closed up +0.06%…. The industry with the best average Zacks Rank would be considered the top industry (1 out of 265), which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank (265 out of 265) would place in the bottom 1%.

(SWAV) raised $75 million in an initial public offering on Thursday, March 7th 2019. The company issued 5,000,000 shares at a price of $14.00-$16.00 per share. Morgan Stanley and BofA Merrill Lynch acted as the underwriters for the IPO and Wells Fargo Securities and Canaccord Genuity were co-managers. MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. Given that Shockwave Medical doesn’t pay any dividend to its shareholders, we infer that the company has been reinvesting all of its profits to grow its business.

SWAV earnings call for the period ending September 30, 2022. SWAV earnings call for the period ending December 31, 2022. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

Data may be intentionally delayed pursuant to supplier requirements. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer. Style is an investment factor that has a meaningful impact on investment risk and returns. Style is calculated by combining value and growth scores, which are first individually calculated.

As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style.

- There are currently 1 hold rating and 6 buy ratings for the stock.

- More value-oriented stocks tend to represent financial services, utilities, and energy stocks.

- Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money.

- By redistributing blood flow within the heart, the Reducer is designed to provide relief to the millions of patients worldwide suffering from refractory angina who have no other treatment options.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now. Highlights important summary options statistics to provide a forward looking indication of investors’ sentiment. This section shows the Highs and Lows over the past 1, 3 and 12-Month periods.

For example, a price above its moving average is generally considered an upward trend or a buy. According to 11 analysts, the average rating for SWAV stock is “Buy.” The 12-month stock price forecast is $285.45, which is an increase of 32.39% from the latest price. Dividend yield allows investors, particularly those interested in dividend-paying stocks,

to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price.